Savvy traders never pay full fees. Use these referral codes to save for life: Binance WZ9KD49N / OKX 26021839

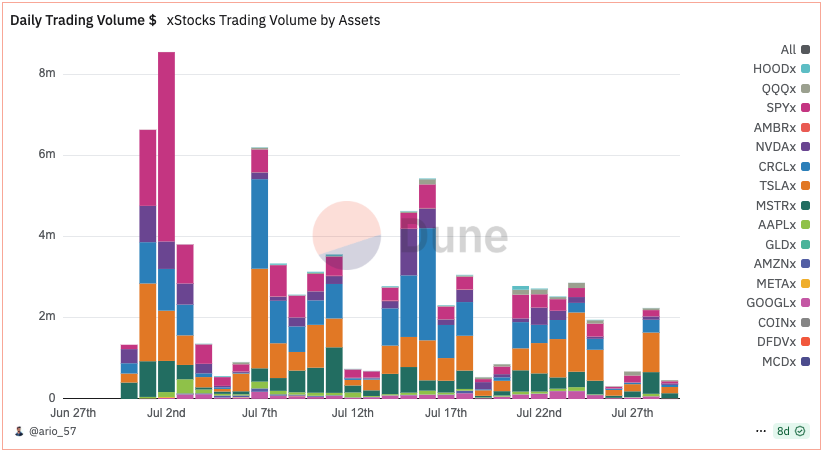

The xStocks platform has achieved a significant milestone, surpassing $2 billion in total trading volume. This growth was largely driven by the trading of tokenized Tesla stock, which played a key role in pushing the platform past this threshold.

Since its launch, xStocks has recorded $2 billion in cumulative trading volume. The platform operates across both centralized and decentralized exchanges, collaborating with major players such as Raydium and Kraken.

Tokenized stocks are gaining traction among traders, with xStocks breaking the $2 billion mark just over a month after its launch on August 6. This figure reflects the combined volumes from various platforms, highlighting the growing interest in digital representations of traditional assets.

The top-performing assets on xStocks include xTSLA, Circle, and SPYx, which track the performance of Tesla, Circle, and the S&P 500 index, respectively. For example, the cumulative trading volume for xTSLA reached $20.9 million by July 27.

A large portion of the trading volume comes from centralized exchanges, with $1.92 billion in cumulative transactions. Meanwhile, on-chain and decentralized exchange (DEX) trading accounted for $100 million since the platform’s launch in late June.

As the popularity of tokenized stocks continues to rise, xStocks has become a leading platform in this space. The platform’s success has also contributed to the dominance of the Solana network in the tokenized stock market, with Solana-based assets accounting for around 95% of the total trading volume.

This growth is supported by strategic partnerships with major projects such as Raydium, Jupiter, and XT.com. Additionally, xStocks is available on several centralized exchanges, including Kraken and Gate, further expanding its reach.

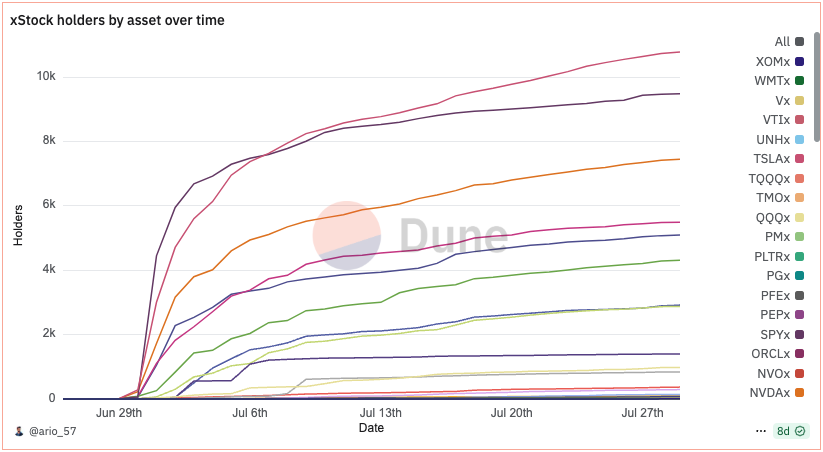

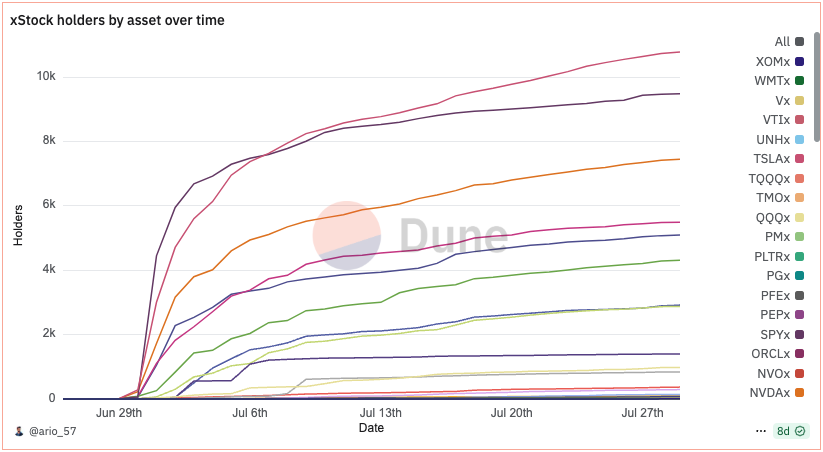

In addition to volume growth, xStocks has seen an increase in the number of tokenized stock holders. On August 6, the platform reported 24,542 total holders of tokenized stocks, with TSLAx being the most popular, having 10,777 holders. The S&P 500 tokenized asset followed closely with 9,483 holders.

With its strong performance and expanding ecosystem, xStocks is positioning itself as a key player in the evolving world of tokenized finance. As more investors explore digital alternatives to traditional equities, platforms like xStocks are likely to play a central role in shaping the future of financial markets.

What is xStocks? xStocks is a platform that provides users with access to stock market data, trading tools, and analysis to help them make informed investment decisions.

What is xStocks?

xStocks is a comprehensive financial platform designed to empower investors with the tools, data, and insights necessary to make informed investment decisions. Whether you’re a seasoned trader or a beginner just starting out in the stock market, xStocks offers a user-friendly interface combined with advanced features that cater to a wide range of financial goals and strategies.

At its core, xStocks provides real-time access to stock market data, including price movements, trading volumes, and company fundamentals. This information is essential for investors who want to stay updated on market trends and make timely decisions. The platform also offers historical data, which can be used for technical analysis and long-term investment planning.

In addition to market data, xStocks equips users with powerful trading tools. These include customizable charts, technical indicators, and automated alerts that help users track their portfolios and monitor potential opportunities. The platform supports various trading styles, from day trading to long-term investing, ensuring that each user can tailor their experience to suit their preferences.

For those looking to deepen their understanding of the stock market, xStocks also provides expert analysis and educational resources. From in-depth research reports to video tutorials and webinars, the platform aims to enhance users’ financial literacy and confidence. This makes xStocks not just a tool for trading, but also a valuable learning resource for anyone interested in building wealth through the stock market.

Overall, xStocks is more than just a stock market platform—it’s a holistic solution that combines data, tools, and education to support investors at every stage of their journey. By leveraging the capabilities of xStocks, users can gain a competitive edge in the dynamic world of finance.

What does “cumulative volume” mean? Cumulative volume refers to the total number of shares traded over a period, indicating the level of interest or activity in a particular stock or market.

What Does “Cumulative Volume” Mean?

Cumulative volume is a key concept in financial markets, particularly in the context of stock trading and market analysis. It refers to the total number of shares that have been traded over a specific period of time. This metric provides valuable insights into the level of interest or activity surrounding a particular stock or an entire market.

Unlike simple volume, which typically measures the number of shares traded in a single day, cumulative volume aggregates this data over a longer timeframe. For example, it could represent the total number of shares traded over the course of a week, a month, or even the entire history of a stock’s trading. This makes cumulative volume a useful tool for identifying trends and gauging investor sentiment.

In practical terms, a rising cumulative volume can indicate increased buying or selling pressure, suggesting that more investors are actively participating in the market. Conversely, a stagnant or declining cumulative volume might signal a lack of interest or uncertainty among traders. Analysts often use cumulative volume in conjunction with other technical indicators, such as price movements and moving averages, to make more informed trading decisions.

It’s important to note that cumulative volume should be interpreted in the context of price action. A significant increase in volume without a corresponding change in price may suggest indecision among market participants, while a surge in volume paired with a sharp price movement could indicate strong momentum or a potential trend reversal.

Overall, understanding cumulative volume can help investors and traders assess the strength of a trend, identify potential breakout points, and gain a deeper understanding of market dynamics. As with any financial metric, it’s most effective when used alongside other analytical tools and not relied upon in isolation.

What is TSLAx? TSLAx is an exchange-traded fund (ETF) that tracks the performance of the S&P 500 Index, offering investors a way to gain exposure to a broad range of U.S. stocks.

What is TSLAx?

TSLAx is an exchange-traded fund (ETF) that provides investors with a convenient and diversified way to gain exposure to the U.S. stock market. Specifically, TSLAx tracks the performance of the S&P 500 Index, one of the most widely followed benchmarks for the overall health of the U.S. economy.

The S&P 500 Index is composed of 500 large-cap U.S. companies across various industries, including technology, healthcare, financials, and consumer goods. By investing in TSLAx, investors effectively own a proportional share of all these companies, which helps to spread out risk and reduce the impact of poor performance by any single stock.

TSLAx is managed by BlackRock, one of the world’s largest asset management firms, and is listed on the Nasdaq stock exchange under the ticker symbol TSLAx. As an ETF, it offers the flexibility of being traded throughout the day like a stock, while also providing the benefits of a diversified portfolio similar to that of a mutual fund.

For both novice and experienced investors, TSLAx serves as a simple and effective tool for long-term wealth accumulation. It is particularly popular among those seeking broad market exposure without the need to individually select and manage a portfolio of stocks. Additionally, its low expense ratio makes it an attractive option for cost-conscious investors.

In summary, TSLAx is a powerful investment vehicle that allows individuals to participate in the growth of the U.S. stock market through a single, easy-to-manage security. Whether you’re looking to build a retirement portfolio, diversify your holdings, or simply keep pace with the broader market, TSLAx offers a reliable and accessible solution.

Why is TSLAx leading? TSLAx may be leading due to strong performance, high trading volume, or positive market sentiment toward the S&P 500 index it represents.

Why is TSLAx Leading?

The iShares S&P 500 Trust ETF (TSLAx) has emerged as a leading player in the exchange-traded fund (ETF) market, and its success can be attributed to several key factors. As one of the most popular and liquid ETFs tracking the S&P 500 index, TSLAx offers investors a straightforward way to gain exposure to the U.S. equity market. Its strong performance, high trading volume, and positive market sentiment toward the S&P 500 index all contribute to its leadership position.

Strong Performance

TSLAx has consistently delivered solid returns over the years, reflecting the long-term growth of the S&P 500. The index, which includes 500 of the largest publicly traded companies in the United States, has historically outperformed many other asset classes. This steady growth has made TSLAx an attractive option for both individual and institutional investors seeking broad market exposure with relatively low risk.

High Trading Volume

One of the primary reasons TSLAx leads in the ETF space is its high trading volume. With millions of shares traded daily, TSLAx offers excellent liquidity, making it easy for investors to buy and sell without significantly impacting the price. This liquidity also contributes to tighter bid-ask spreads, reducing transaction costs for traders and enhancing overall market efficiency.

Positive Market Sentiment

Market sentiment plays a crucial role in the popularity of TSLAx. As the S&P 500 is often seen as a barometer of the U.S. economy, positive sentiment toward the index naturally translates into increased demand for TSLAx. During periods of economic expansion or bullish market conditions, investors tend to favor ETFs that track the S&P 500, further boosting TSLAx’s prominence in the market.

Conclusion

In summary, TSLAx’s leadership in the ETF market is driven by its strong historical performance, high trading volume, and the positive sentiment surrounding the S&P 500 index. These factors combine to make TSLAx a trusted and widely used investment vehicle for those looking to participate in the U.S. equity market. As long as the S&P 500 continues to perform well and maintain its status as a benchmark for global markets, TSLAx is likely to remain a top choice among investors.

Why does xStocks reaching $2 billion in volume matter? A high cumulative volume on xStocks suggests increased user activity and confidence in the platform, which can be a sign of its growing popularity and reliability.

Why Does xStocks Reaching $2 Billion in Volume Matter?

The achievement of a $2 billion cumulative trading volume on xStocks is a significant milestone that signals several important developments within the platform and the broader crypto ecosystem. This figure is not just a number; it represents a growing user base, increased liquidity, and a rising level of trust among traders and investors.

One of the primary reasons this volume matters is because it reflects heightened user activity. As more individuals and institutions engage with the platform, they contribute to a more dynamic and liquid market. A high trading volume often correlates with greater price stability and reduced slippage, making it easier for users to execute trades at favorable prices.

Moreover, reaching such a substantial volume can be seen as a validation of xStocks’ reliability and security. In the world of cryptocurrency, where volatility and risk are inherent, platforms that demonstrate consistent performance and robust infrastructure tend to attract more users. The $2 billion threshold serves as a benchmark that showcases the platform’s ability to handle large-scale transactions without compromising safety or efficiency.

This milestone also indicates the growing popularity of xStocks as a go-to platform for crypto trading. As more users join, the network effect comes into play, further driving adoption and creating a self-reinforcing cycle of growth. Increased participation can lead to more diverse trading pairs, enhanced features, and improved user experiences, all of which contribute to the platform’s long-term success.

In addition, a high trading volume can have positive implications for the broader crypto market. It may encourage other projects and developers to integrate with xStocks, leading to a more interconnected and vibrant ecosystem. Furthermore, it can attract institutional interest, as large players often look for platforms with strong liquidity and proven track records before committing capital.

Ultimately, the $2 billion volume mark is more than just a financial achievement—it is a testament to the confidence and engagement of the community. It underscores the potential of xStocks as a reliable and innovative player in the evolving world of digital finance. As the platform continues to grow, this milestone will likely serve as a foundation for future expansion and innovation.

Questions and Answers about xStocks

Questions and Answers about xStocks

Question 1: What is the total trading volume of xStocks?

Answer 1: The xStocks platform has reached a cumulative trading volume of $2 billion since its launch.

Question 2: How did xStocks reach $2 billion in trading volume?

Answer 2: The platform achieved this milestone largely due to increased trading activity in Tesla tokenized stock, which pushed the total volume over the $2 billion mark.

Question 3: What are tokenized stocks?

Answer 3: Tokenized stocks are digital representations of traditional stocks on a blockchain. They allow for easier and faster trading, as well as greater accessibility for investors.

Question 4: Does xStocks work with both centralized and decentralized exchanges?

Answer 4: Yes, xStocks partners with both centralized and decentralized exchanges to facilitate the trading of tokenized assets.

Question 5: Why are tokenized stocks becoming popular?

Answer 5: Tokenized stocks are gaining popularity because they offer transparency, security, and efficiency in trading, making them an attractive option for modern traders.