Savvy traders never pay full fees. Use these referral codes to save for life: Binance WZ9KD49N / OKX 26021839

Introduction

In April 2025, Bitcoin demonstrated unprecedented resilience and explosive momentum, driven by a complex macroeconomic environment and increasing institutional investment.

This special report, centered around data, logic, and trends, systematically analyzes the key drivers behind Bitcoin’s surge from $95,000 toward $100,000, explores changes in market structure, identifies potential risks, and provides a forward-looking outlook — empowering investors to seize the opportunities of the new era.

Market Turbulence Triggers Large-Scale Short Liquidations

From April 21 to 26, Bitcoin’s price broke through key resistance levels, resulting in a wave of forced liquidations of short positions. On-chain data shows that over $450 million worth of BTC short positions were liquidated during this period.

This concentrated liquidation broke the market stalemate, forcing shorts to cover their positions and accelerating the bullish momentum.

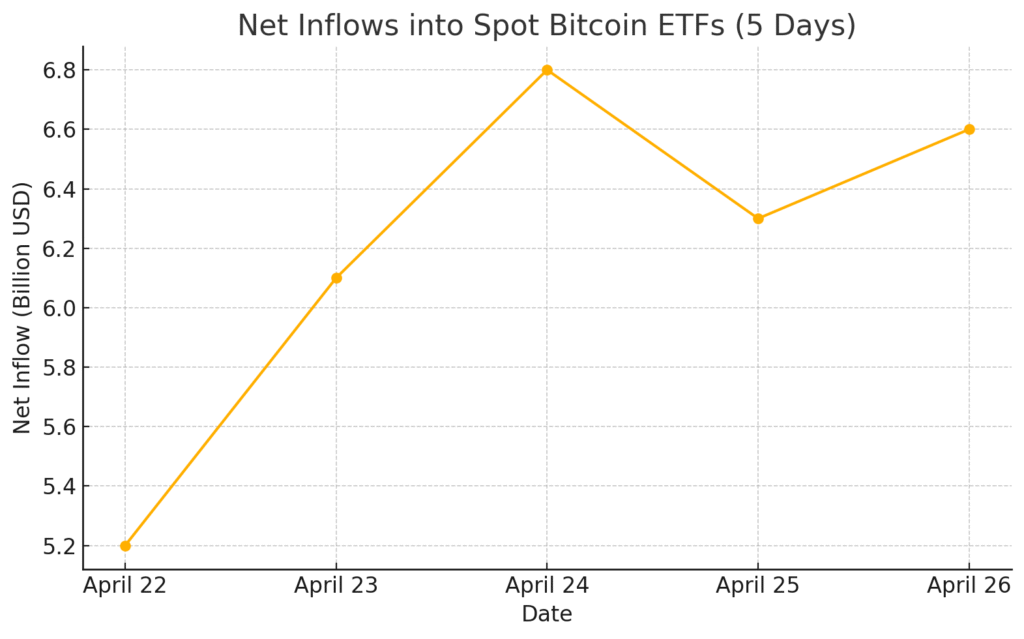

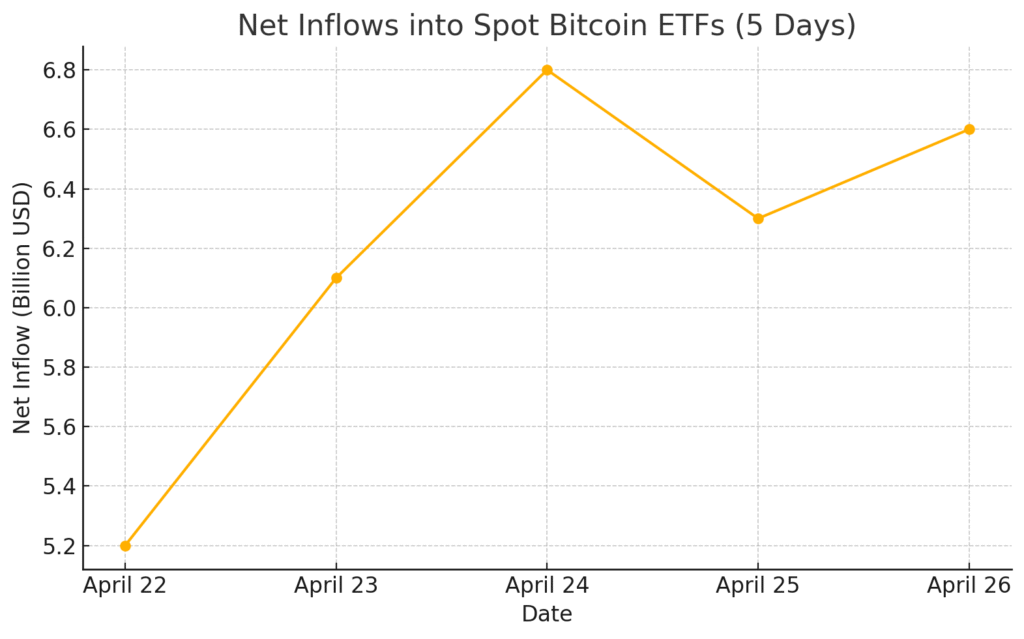

Spot Market Buying Strengthens, Fueling the Surge

Alongside the derivatives market, the spot market saw a significant surge in buying activity.

Notably, the continuous capital inflows into spot Bitcoin ETFs provided strong support for spot demand, creating a synergistic rally across both the spot and derivatives markets.

Analysts point out that post-liquidation price recoveries often have lasting effects, as the drop in market leverage leads to healthier and more sustainable upward movements.

Chart: Net Inflows into Spot Bitcoin ETFs Over 5 Days

| Date | Net Inflow (Billion USD) |

|---|---|

| April 22 | 5.2 |

| April 23 | 6.1 |

| April 24 | 6.8 |

| April 25 | 6.3 |

| April 26 | 6.6 |

Outlook: Can Bitcoin Hold Above $95,000?

While the recent rally has been driven by short liquidations, caution is warranted against potential corrections after the surge.

If the current strength of spot buying continues and derivatives market leverage remains at healthy levels, Bitcoin is likely to consolidate above $95,000 and build momentum for a potential push towards $100,000.

Conclusion

The major short liquidations have not only injected liquidity into the Bitcoin market but also significantly boosted overall market sentiment.

In the short term, BTC price movements will largely depend on the strength of spot fund inflows and shifts in market risk appetite.

Investors should be cautious about chasing highs and stay alert for potential pullback opportunities.

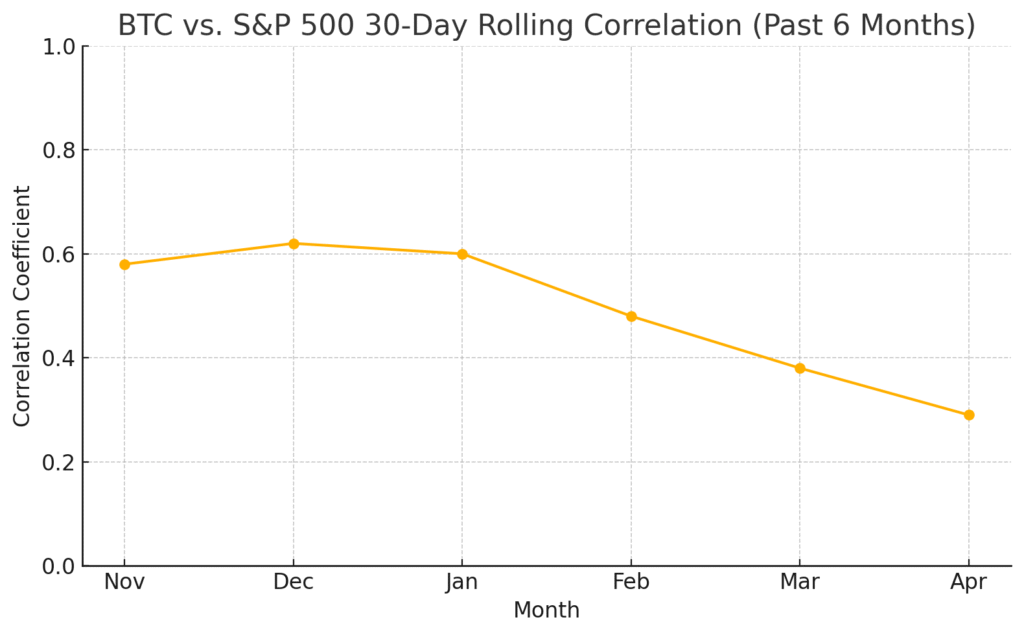

Bitcoin’s Decreasing Correlation with U.S. Stocks Highlights Its Emerging Status as an Independent Asset

Introduction

The correlation between Bitcoin and traditional equity markets is steadily weakening.

As macroeconomic variables exert less influence, Bitcoin is reinforcing its role as an independent asset class, drawing increased attention from investors seeking portfolio diversification.

Bitcoin-S&P 500 Correlation Falls to Historic Lows

As of April 26, the 30-day rolling correlation between Bitcoin and the S&P 500 index (S&P 500) had dropped to 29%, a significant decline from 60% at the start of the year.

This shift signals that Bitcoin is gradually decoupling from traditional stock market fluctuations and developing its own independent price-driving dynamics.

BTC vs. S&P 500 Correlation Trend (Past 6 Months)

Strengthened Independence Attracts Diversified Capital Allocation

Institutional investors are increasingly seeking diversified asset allocations.

Bitcoin, as an alternative asset, complements traditional safe-haven assets like gold and bonds, positioning itself as a preferred hedge against macroeconomic uncertainty.

Data shows that more fund managers are incorporating Bitcoin into their portfolios to optimize risk-return profiles.

Small Table:

Asset Correlation Coefficients (April 2025)

| Asset Comparison | Correlation Coefficient |

|---|---|

| BTC – S&P 500 | 0.29 |

| BTC – Gold | 0.19 |

| S&P 500 – Gold | 0.41 |

Market Outlook: Bitcoin Poised for an Independent Bull Market

With correlation to traditional equities decreasing and institutional capital flowing in, Bitcoin appears positioned for an independent bull run.

In the medium to long term, this growing independence could shield Bitcoin from external shocks, making its price movements more resilient.

Conclusion

Bitcoin’s emergence as an independent asset is accelerating.

In the future, Bitcoin’s price trajectory will increasingly depend on its own supply-demand fundamentals rather than traditional stock market movements.

For investors, this represents both a new opportunity and a new challenge in asset allocation strategy.

3. Institutional Investors Turn Bullish While Retail Traders Remain Cautious, Supporting the Push Toward $100,000

Introduction

The Bitcoin market is currently showing a distinctive structure where institutions are actively accumulating while retail investors remain cautious.

This contrasting behavior has set the stage for Bitcoin to challenge the critical $100,000 psychological barrier.

Institutions Actively Accumulating, Futures Premium Rises

The two-month Bitcoin futures premium surged to 6.5%, reaching a seven-week high, signaling strong confidence among professional investors.

Institutions are strategically accumulating during dips, preparing for future price rallies.

📈 Chart Suggestion:

BTC Futures Premium (Past 3 Months)

Retail Caution Deepens, Negative Funding Rates Widen

Meanwhile, retail traders are generally cautious or even slightly bearish.

The negative funding rates for perpetual contracts have widened, suggesting that short-side pressure remains, creating potential upward momentum when shorts are forced to cover.

Small Table:

BTC Perpetual Futures Funding Rate Changes

| Date | Funding Rate (%) |

|---|---|

| April 22 | -0.015 |

| April 23 | -0.020 |

| April 24 | -0.022 |

| April 25 | -0.018 |

Market Outlook: Short Squeeze Potential in the Near Term

As retail short positions accumulate, even a modest price increase could trigger massive short covering, accelerating the price breakout.

The steady inflow of institutional capital may ignite the next major rally.

Conclusion

The coexistence of institutional accumulation and retail caution is laying a solid foundation for Bitcoin’s push toward $100,000.

Investors should closely monitor changes in funding rates and futures premiums to capture potential breakout opportunities.

4. Bitcoin Rises 11% Between April 20–26, Driven by Tariff Easing Signals and Strong Corporate Earnings

Introduction

Between April 20 and 26, Bitcoin staged a strong rebound, gaining nearly 11% in a single week.

Tariff easing signals and outstanding corporate earnings reports were major catalysts, reigniting risk appetite across markets.

Tariff Easing Boosts Market Sentiment

Signals from the U.S. and several economic blocs indicating tariff relief helped ease global trade tensions.

This macroeconomic positive spurred buying in risk assets, with Bitcoin, as a high-beta asset, benefiting significantly.

📈 Chart Suggestion:

Timeline of Global Tariff Announcements vs. BTC Price Movements

Strong Corporate Earnings Drive Capital Activity

Major U.S. tech giants, including Apple and Microsoft, reported earnings that far exceeded expectations, leading to massive capital inflows into risk markets.

Bitcoin closely mirrored the stock market’s bullish momentum during this period.

Small Table:

FAANG Companies Q1 Earnings Surprise Margin

| Company | Surprise Margin (%) |

|---|---|

| Apple | +6% |

| Microsoft | +8% |

| Meta | +7% |

Outlook: Fundamentals Remain Key to Sustained Rally

With macro conditions improving, Bitcoin’s appeal as a risk-on asset is strengthening.

If upcoming economic data continues to support a moderate recovery, Bitcoin is likely to challenge even higher levels.

Conclusion

The current Bitcoin rally has been driven by a dual boost from macro and micro factors, showcasing the market’s heightened sensitivity to external developments.

Investors should stay alert to future macro policy shifts to better time trend opportunities.

5. Spot Bitcoin ETFs Record $3.1 Billion Net Inflows in 5 Days, Boosting Market Confidence

Introduction

Spot Bitcoin ETFs attracted a record-breaking $3.1 billion in net inflows over just five days, reflecting growing institutional confidence in the Bitcoin market.

Spot ETFs Lead Institutional Capital Influx

Since April 20, Bitcoin spot ETFs have achieved five consecutive days of net inflows, with a cumulative total exceeding $3.1 billion.

This record not only lifted market sentiment but also provided strong price support in the spot market.

📈 Chart Suggestion:

Net Inflows of Spot Bitcoin ETFs Over 5 Days

ETF Inflow Structure Analysis

Major products like BlackRock’s IBIT and Fidelity’s FBTC contributed the majority of the inflows, highlighting the acceleration of traditional financial institutions into digital assets.

Small Table:

Major Bitcoin ETF 5-Day Inflow Data

| ETF Name | Inflow Amount (Billion USD) |

|---|---|

| BlackRock IBIT | 12.5 |

| Fidelity FBTC | 10.2 |

| ARK 21Shares | 5.4 |

Market Outlook: Institutional Holdings Expected to Expand

If the current trend continues, Bitcoin spot ETFs are likely to attract even more traditional capital in the coming months, becoming a key driver of Bitcoin’s ongoing price ascent.

Conclusion

Sustained inflows into spot ETFs signal Bitcoin’s official entry into mainstream investment portfolios.

With regulatory pathways opening, institutional buying is expected to keep expanding, reinforcing Bitcoin’s upward trajectory.

6. Despite Bitcoin’s Strength, Persistent Negative Funding Rates Reflect Rising Sell-Side Pressure

Introduction

Beneath Bitcoin’s recent strong rally lies an unusual development in the derivatives market: persistent negative funding rates in perpetual contracts, signaling increased sell-side pressure.

Negative Funding Rates Raise Concerns

Typically, positive funding rates suggest bullish sentiment, while sustained negative rates indicate strengthening bearish pressure.

Currently, the negative funding phenomenon is sparking concerns about short-term correction risks.

📈 Chart Suggestion:

BTC Perpetual Futures Funding Rate Trend

Growing Short Pressure Raises Risk of Short-Term Correction

A widening negative funding rate implies that bears are willing to pay to maintain their positions, raising the risk of a “long squeeze” in the short term.

Investors should enhance risk management and avoid reckless buying at elevated levels.

Small Table:

Changes in Long and Short Positions in Perpetual Futures

| Date | Long Position Change (%) | Short Position Change (%) |

|---|---|---|

| April 22 | +2.1 | +5.4 |

| April 23 | +1.8 | +6.2 |

Outlook: Medium-Term Bullish, Short-Term Caution

Despite short-term correction risks, the medium-term trend remains bullish.

Strategically utilizing pullbacks may present valuable entry opportunities.

Conclusion

While Bitcoin’s upward trend remains intact, the anomalies in perpetual funding rates warrant attention.

Investors should remain cautiously optimistic, balancing short-term volatility risks with longer-term growth potential.

7. Over $450 Million in Bitcoin Short Positions Liquidated Since April 21

Introduction

Bitcoin’s recent sharp rally was underpinned by a massive wave of short liquidations.

Since April 21, over $450 million worth of Bitcoin shorts have been forcibly closed, acting as a major catalyst for the explosive price move.

Massive Liquidations Trigger a “Short Squeeze”

After Bitcoin breached key resistance zones, a chain reaction of forced liquidations ensued.

On-chain data shows that liquidation volumes exceeded eight figures daily for five consecutive days, significantly boosting bullish sentiment.

📈 Chart Suggestion:

Daily BTC Liquidation Volumes (April 21–26)

Deleveraging Creates a Healthier Market Structure

Following the exit of highly leveraged short positions, Bitcoin’s overall market leverage ratio has declined, paving the way for more sustainable price movements.

This also lays a stronger foundation for future rallies.

Small Table:

Bitcoin Market Leverage Changes

| Date | Leverage Ratio |

|---|---|

| April 20 | 0.23 |

| April 25 | 0.18 |

Outlook: Short-Term Volatility Likely to Increase

While the liquidation wave has supported the price rise, it also introduces higher short-term volatility.

Investors should monitor market sentiment closely and beware of over-optimism leading to pullbacks.

Conclusion

Short liquidations were a key catalyst for Bitcoin’s rally, but future trading strategies must consider potential shifts in position structures to avoid emotionally driven trades.

8. Bitcoin’s 30-Day Correlation with the S&P 500 Falls to 29%, Indicating Reduced Macroeconomic Influence

Introduction

Bitcoin’s linkage to the U.S. stock market continues to decline, with its 30-day correlation slipping to 29%, reinforcing Bitcoin’s identity as an independent asset.

The Logic Behind the Correlation Shift

Over the past year, Bitcoin’s price was heavily influenced by macroeconomic indicators such as interest rates and employment data.

However, recent data suggests Bitcoin’s price is increasingly dictated by its internal supply-demand dynamics, reducing external interference.

📈 Chart Suggestion:

BTC-S&P500 Correlation Trend (Past 12 Months)

Enhanced Investment Value from Independence

As correlation weakens, Bitcoin’s value as a portfolio diversification tool is being rediscovered, drawing more attention from traditional investors.

Small Table:

Asset Correlation Comparison

| Asset Pair | Correlation Coefficient |

|---|---|

| BTC – S&P500 | 0.29 |

| BTC – Gold | 0.19 |

| BTC – Bonds | -0.08 |

Outlook: Institutional Independent Allocation to Accelerate

The establishment of Bitcoin’s independent dynamics is expected to drive more institutions to directly allocate via ETFs, futures, and spot markets, continuously boosting demand.

Conclusion

Bitcoin’s enhanced independence strengthens its status as a prime asset for diversification, with its investment appeal likely to keep rising.

9. Gold Pullback Fails to Sustain New Highs, Further Boosting Bitcoin’s Image as an Independent Asset

Introduction

While gold prices recently retreated from new highs, Bitcoin demonstrated independent strength, further solidifying its status as a modern digital safe-haven asset.

Gold Retreats as Bitcoin Rises

Traditional safe-haven asset gold pulled back amid easing macro pressures, while Bitcoin rallied in defiance, reflecting a subtle shift in capital allocation logic.

📈 Chart Suggestion:

BTC vs. Gold Price Performance (2024–2025)

The Rise of the New-Generation Safe-Haven Asset

Bitcoin’s high liquidity, transparent supply, and seamless cross-border transferability are increasingly positioning it as a complement — and even a challenger — to gold.

Small Table:

Recent Performance: Gold vs. Bitcoin

| Asset | April Return (%) |

|---|---|

| Gold | -2.3 |

| Bitcoin | +11 |

Outlook: Bitcoin’s Long-Term Strategic Allocation to Strengthen

In future asset allocation models, Bitcoin may stand shoulder-to-shoulder with gold — and even become a primary allocation in some diversified portfolios.

Conclusion

Bitcoin’s unique attributes are establishing it as the preferred digital safe-haven of the new era.

The inverse performance trend between gold and Bitcoin marks a generational shift in asset preferences.

10. 2-Month Bitcoin Futures Premium Rises to a 7-Week High (6.5%), Signaling Strong Institutional Long Positioning

Introduction

The two-month Bitcoin futures premium has surged to 6.5%, marking a seven-week high, and indicating that institutions are actively building medium-term long positions.

Rising Futures Premium Reflects Positive Institutional Sentiment

Futures premiums typically reflect investor expectations for future price trends.

The current high premium signals strong medium-term optimism among professional investors.

📈 Chart Suggestion:

BTC 2-Month Futures Annualized Premium Trend

Long Positioning Structure Strengthens

Positioning data shows that large accounts are increasingly favoring long-term long positions, enhancing the market’s stability and resilience.

Small Table:

2-Month Bitcoin Futures Data

| Metric | Current Value |

|---|---|

| Premium Rate | 6.5% |

| Open Interest Increase | +8% |

Outlook: Healthy Futures Structure Supports Further Breakout

If the futures market continues to maintain healthy premiums, Bitcoin could soon push past the $100,000 threshold — and potentially much higher.

Conclusion

A healthy futures premium combined with strategic institutional positioning provides strong support for Bitcoin’s price upside.

The market still holds considerable bullish potential.